Find the Best AMS & CRM for Your Insurance Agency

Are you utilizing an AMS/CRM to streamline your agency’s operations, increase your team’s productivity and grow your revenue?

When it comes to searching for an Agency Management System (AMS) or Customer Relationship Management (CRM) system, you can quickly become overwhelmed by all the solutions that are offered.

Your business is built on building meaningful customer relationships and retaining them for maximum profitability, so it is crucial to find systems that will fit your business model and allow you to gain a significant return on your short-term and long-term investment.

When looking for the right systems solution partner, it is best to prioritize the features that are important to your agency’s growth objectives.

What is an Agency Management System?

An agency management system is a software-as-a-service (SaaS) program that assists insurance agencies in organizing and running their business more efficiently.

An AMS program can assist your business with operations, reporting, commissions, sales metrics, and more. These programs may also have some marketing capabilities, but typically nothing too in-depth. An AMS system will improve the effectiveness of your agency and help you identify which day-to-day processes are promoting or hindering your business growth.

What is a Customer Relationship Management System?

A customer relationship management system is software that connects all of your customer data to one hub. This lets you nurture clients and leads, speed up your communication process, and help you protect your customer’s data.

Utilizing a CRM system allows you to organize and track your sales funnel, and to keep track of every customer interaction that you or your team have. CRM programs also typically have advanced marketing and automation capabilities to assist in your business development and outreach.

What are the benefits of using an AMS/CRM?

Just like insurance sales, a CRM system is customer-centric. With an efficient CRM system in place, you can automate your agency’s day-to-day operations and focus on the things that matter: customer care, retention, and revenue.

With an effective AMS system you will have access to analytical and reporting features, that will allow you to monitor your employees, customer base, day to day operations, and push raw data out in understandable metrics to help you run your business more effectively.

Data and Reporting

Gain insights into your customer base and discover new ways to better serve your clients. Analyze your data to pinpoint customer service issues and determine the best resolutions for adapting to any negative common trends. Additionally, track what creates customer best practices and double down on that activity, conduct training, and reward those that show quality performance and overall employee improvement.

Collecting and analyzing customer data will help you truly understand your customers and anticipate their needs for higher retention, and customer satisfaction, alongside monitoring your own internal activity.

Lead Tracking

Lead tracking is a key practice to implement to increase lead generation and conversion rates for your company. Knowing where your leads come from and the actions they take while they progress through the sales funnel will provide you with a better understanding of your audience and increase your agency’s closing rates and overall profits. Lead disposition data is the key to maximizing your lead ROI.

Positive Customer Service Experiences

Keeping accurate records of all customer interactions (emails, calls, texts, and even life events) will assist your team in providing an excellent customer service experience. Collective data brings whoever is helping your client up to speed on any interactions both positive and negative, that a customer has previously had with your company, allowing you to provide streamlined quality service. Top-notch customer service is a definitive and measurable growth aspect of your business that will truly set you apart from any competition.

Marketing Capabilities

Increase your marketing and cross-promotional advertising with CRM automation and move leads through your sales funnel, retain more business and obtain more referrals than ever before. A CRM system allows you to build out robust customer journeys and provides each customer with a curated unique experience. Additionally, you can automate your retention and cross-promotional marketing strategies on action-based triggers, saving your agency valuable time and money.

What are the pros and cons of each CRM/AMS program?

An AMS or CRM system is a huge investment of time and money for your agency, so it is essential to select the right program upfront. Choosing the wrong systems will cost you time, money, and worse yet customer relationships and opportunity.

We researched several CRM and AMS options that exist in the Insurance Tech market-space and found the top features, benefits, and drawbacks of each so you can make an informed decision.

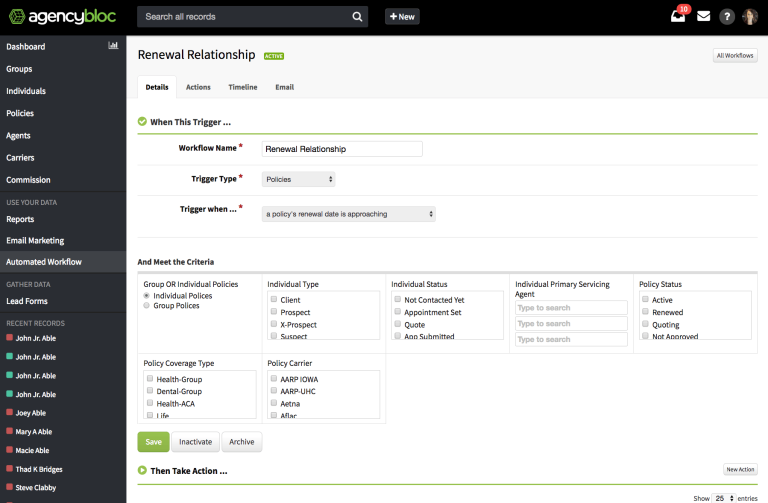

Agencybloc

Top Features

- Life & Health Insurance Policy Management

- Activity Management and Tracking

- Document Management

- Sales Forecasting

- Performance Metrics, Reporting/Analytics, Sales Reports

- Commission Management

Benefits

- User-friendly and easy to learn

- Customer service is responsive

- Pre-set templates for agencies

- On-demand training tools

- Customizable

Drawbacks

- Too much customization can lead to confusion when setting up the program and cause issues if fields aren’t set up properly

- For life and health insurance it can be limiting

- The sales dashboard is often not customizable to your team’s specific needs

- Users have experienced difficulty with program integrations

- Additional system feature costs add to monthly costs

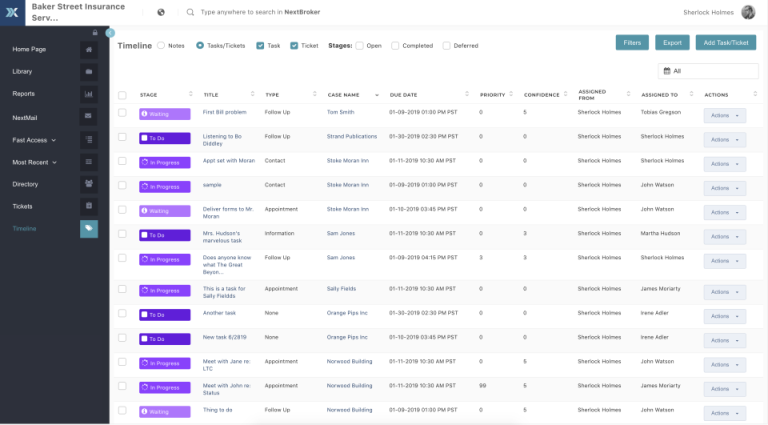

NextAgency

Top Features

- Life & Health Insurance Policy Management

- Customizable Fields and Templates

- Sales Pipeline Management

- Reporting and Analytics

- Data Import/Export

- Document Storage

- Commission Overrides and Statements

Benefits

- Very user-friendly

- Responsive and fast customer service

- Prospect, client, and carrier information all in one spot

- Accurate commission tracking

- NAHU member discount

Drawbacks

- Frequent updates that can cause confusion

- Less control over default settings

- User interface can be complex

- Additional system feature costs add to monthly cost

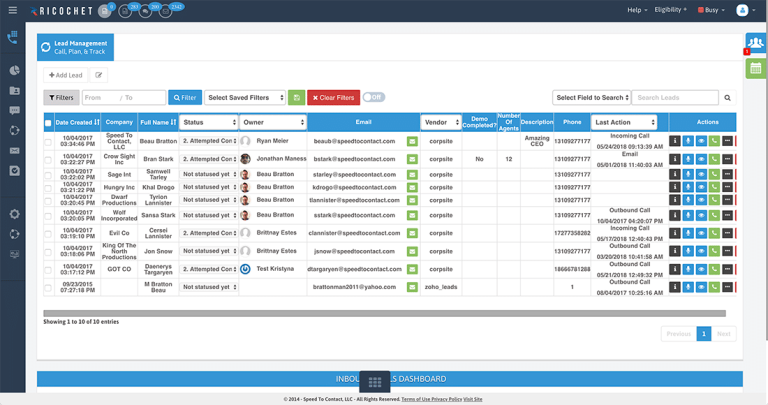

Ricochet360

Top Features

- Activity Dashboard

- Contact & Lead Management

- Reporting & Analytics

- Predictive Dialer

- Live Chat

- Call Recording, Routing, Scripting & Transferring

Benefits

- User-friendly experience

- Auto-dialer capabilities

- Easy to learn

Drawbacks

- No mass assignment of leads

- No mass updating or deleting of leads which increases time spent manual updating

- Basic reporting and data

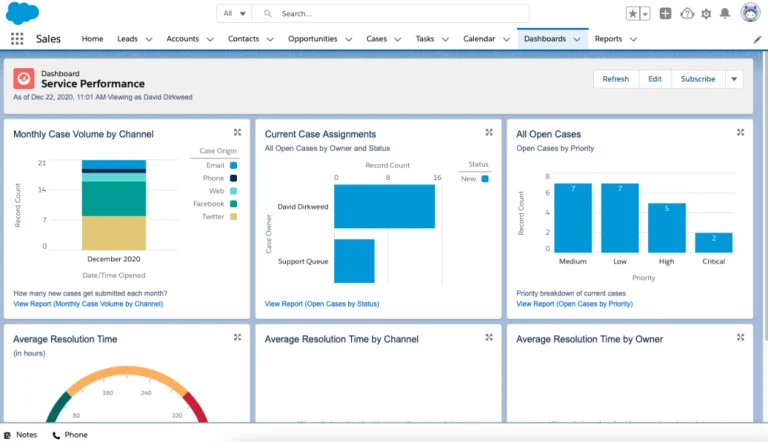

Salesforce

Top Features

- Lead and Contact Management

- Performance Metrics

- Sales Funnel Tracking

- Task Scheduling

- Project Management

Benefits

- Provides tools that help agencies better connect to their customers

- Allows you to manage and maintain account and lead level data that are connected

- Easy storage of documents

- Intuitive reporting

- Customizable dashboard depending on the role in the agency

- Ability to build out landing pages

Drawbacks

- Costly

- Customer service is not as streamlined due to their size

- Not built specifically for the insurance industry and could require programmers to customize your system to fit your specific needs

- May need programmer support for migrating data, which can add to total costs

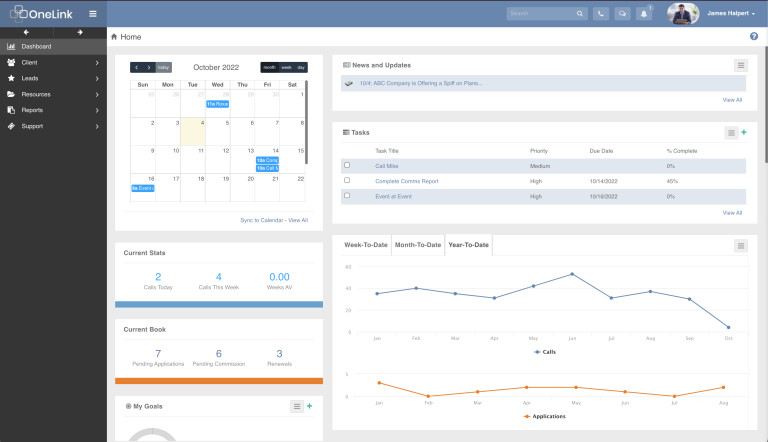

OneLink

Top Features

- Specializes in Life, Health, and Medicare

- Robust Analytics and Reporting

- NIPR Database Integration

- Automated predictive dialing

- Custom Email/Text Marketing Campaigns

- Team Management – track compensation, downline, licensing, and documents

- Automated Commission Processing

- Built-in Video Conferencing

Benefits

- Fast, Cloud-Based solution that puts everything at your fingertips

- Import leads from different sources and connects to an autodialer system for your sales team to make efficient cold calls

- Ability to generate simple to complex reports about your business and its performance

- Built specifically to support insurance agencies

- All plans support unlimited contacts

- The ease of use for the end user – an agent can be taught the lead system in 30-60 minutes.

- Comprehensive commission program to customize for your agency

- API capabilities

- Open line of communication with support, always looking to make new developments for the end user

Drawbacks

- Customer service support is only available through phone and email

- IVAN integration is currently unavailable but will be coming soon

- User interface is not flashy and straight to the point

Don’t settle for a CRM that won’t meet all your agency’s needs!

Intruity has developed a customizable all-in-one solution that has served thousands of users over the past decade.

OneLink is next-generation cloud-based software that’s been designed specifically to meet the needs of insurance agencies.

Take full advantage of OneLink AMS & CRM capabilities to communicate with customers across multiple channels and build strong relationships. Use automated communications, and built-in customer management to help your team stay efficient while outperforming the competition.

Experience the product first hand— schedule a Discovery Call today at www.intruity.com/OneLink.